Years after the first Bitcoin ATM was launched in 2013 at a coffee shop in Vancouver, Canada, Bitcoin ATMs have gained worldwide adoption. Bitcoin ATMs help users buy, sell, and trade crypto without using online cryptocurrency exchanges.

In this guide, we shall look into how Bitcoin ATM Fees work and the various charges involved when using them. Let’s dive in:

Table of Contents

ToggleBitcoin ATM Charges Calculator: All Operators

Here you can calculate any charges for any service provider:

Bitcoin ATM Fees Calculator

Key Takeaways

- Bitcoin ATMs fees are the charges that come with converting your Bitcoin to cash or vice versa on a Bitcoin ATM.

- These fees cover regulatory compliance, accessibility, functionality, and customer support.

- Transaction fees vary from 5% to 23%, plus network fees of $1 to $3, depending on the Bitcoin ATM provider.

- Bitcoin ATM exchange fees are different from wallet transfer fees.

- Tips to reduce fees include comparing providers, planning transactions, and researching.

- At CoinTime, we offer low-fee services across 150+ locations globally.

Top 20+ United States Bitcoin ATM Operators Fees

When buying and selling Bitcoin using a Bitcoin ATM, note that different ATMs charge different fees for transacting.

Here are some of the top providers in the United States and how much fee they charge for transactions:

| Bitcoin ATM operator | Buy Fee | Sell Fee |

| Coin Time Atm | 10% to 25% | 10% to 25% |

| CoinFlip Bitcoin ATMs | 3$ + (7.1% to 17.6%) | 5.3% |

| Bitcoin Depot | 20% | – |

| RockItCoin | $ 1 + 18.7% | $ 1 + 16.3% |

| Athena Bitcoin | 10% to 25% | 5% |

| Coinhub Bitcoin | 9.9% to 24.22% | – |

| Unbank | (5$ + 13.1%) to (8$ + 18.1%) | – |

| Just Digital Coin | 4$ + 18.7% | – |

| Bitstop | 13.5% | – |

| National Bitcoin ATM | 10% to 25% | – |

| Margo | 10% to 25% | – |

| Byte Federal | 10% to 25% | – |

| GetCoins | 10% to 25% | – |

| Cash2Bitcoin | 10% to 25% | – |

| BTMmachines | 10% to 25% | – |

| Freedom Gateway | 10% to 25% | – |

| American Crypto Bitcoin ATM | 20% + $1.99 | 4.9% |

| CoinMover | 10% to 25% | – |

| Bitbox ATM | 20% | – |

| HILT | 14.99% | – |

| BitcoinX ATM | 10% to 25% | – |

| CoinGenie | 3$ + (15.5% to 16%) | – |

While our CoinTime ATM fee details aren’t on our website, we offer competitive rates, among the lowest on the market.

Line Graph Showing Top 15 US Bitcoin ATM Operators Buy Fees

At CoinTime, we provide the lowest fees and highest transaction limits in the market.

What are Bitcoin ATM Fees?

Bitcoin ATM fees are the charges for converting your Bitcoin to cash or vice versa at a Bitcoin ATM.

These fees come from the huge operational costs that Bitcoin ATM operators must cover. Here are some of the costs that Bitcoin ATM fees have to cover:

- Regulatory compliance: Licensed and regulated Bitcoin ATMs comply with federal government regulations to ensure safety and security, preventing illicit activities like money laundering. Operators have to adhere to regulatory requirements set forth by lawmakers.

- Accessibility: Bitcoin ATMs are placed in high-traffic areas, enhancing their accessibility for users. Providers incur expenses to install and maintain ATMs in these locations, ensuring their availability and convenience for customers.

- Functionality: Operating a Bitcoin ATM entails costs related to hardware, internet access, security measures, maintenance, and the secure transportation of cash to and from the machines. Fees contribute to these operational aspects to maintain the functionality and security of Bitcoin ATMs.

- Customer support: Bitcoin ATM operators offer customer support services to assist users with inquiries or issues that may arise during transactions. Fees help cover the costs associated with providing efficient and responsive customer support, ensuring a positive user experience.

Type of Bitcoin ATM Fees

There are different types of fees associated with Bitcoin ATMs that you should note:

– Transaction Fees

Users are charged a transaction fee for each transaction at a Bitcoin ATM.

This fee is usually a percentage of the transaction amount, ranging from 5% to 10%.

Some ATMs may also charge a flat fee per transaction, typically a few dollars, to cover operational costs and generate revenue for the operator.

– Exchange Rates

Bitcoin ATMs set the exchange rate. They use it to convert cash into Bitcoin or other cryptocurrencies.

ATM exchange rates change. They may vary and shift during the day due to market conditions.

Bitcoin ATMs generally offer rates slightly higher than the market rate.

They do this to compensate for the risk of holding cryptos and to make a profit.

– Specific Fees

Some Bitcoin ATMs may charge additional fees for specific services, such as wallet creation or cash withdrawals.

These fees vary among ATMs and may not be standard across all machines.

How Much Fees Do Bitcoin ATMs Charge?

When using a Bitcoin ATM to buy or sell Bitcoin, you will come across fees ranging from 5% to 23%.

These fees vary depending on factors such as location, specific ATM provider, and the transaction charge.

The chart below shows the average Bitcoin ATM buy fees charged globally:

Line Graph Showing Buy Fees at Bitcoin ATM Operators

Note that buy fees are charged differently from sell fees when using a Bitcoin ATM. Here are the average sell fees:

Line Graph Showing Sell Fees at Bitcoin ATM Operators

Let’s consider where you want to convert $500 into Bitcoin.

If the Bitcoin ATM charges a 10% fee, you will receive approximately $450 worth of Bitcoin after deducting the fee.

At a 15% fee rate, you would get around $425 worth of Bitcoin.

Apart from these, there are network fees that range from $1 to $3.

These network fees are part of the costs associated with transacting on the Bitcoin network and are not included in the operator’s fees.

Bitcoin ATM Exchange Fees vs. Wallet Transfer Fees

When using a Bitcoin ATM, you are charged an exchange fee.

The ATM operator charges this fee for converting your cash into Bitcoin.

These fees cover operational expenses such as maintenance and compliance.

This fee is usually a percentage of the transaction amount.

On the other hand, when you transfer Bitcoin from your wallet to another’s, you incur a transfer or network fee.

The fee helps the network operate by paying miners who validate and confirm transactions.

The fee amount can vary based on factors such as network congestion and the urgency of your transaction.

According to YCharts data, Bitcoin transaction fees are currently averaging at 5.194, up from 1.699 one year ago.

This growth is in line with the increasing price of Bitcoin.

Essentially, the ATM exchange fee covers the service for converting fiat to Bitcoin, while the wallet transfer fees support Bitcoin transactions across the blockchain network.

How to Avoid Paying High Bitcoin ATM Fees

To minimize fees when buying Bitcoin from an ATM, use these strategies:

- Explore various ATM providers: Different Bitcoin ATM operators may have different fee structures. Look for providers offering competitive rates and lower fees.

- Compare fee schedules: Before using a specific Bitcoin ATM, compare the fees charged by various machines in your area. Some ATMs may impose higher fees than others, so it’s wise to look around first.

- Plan transactions: When you can, combine Bitcoin purchases. This minimizes the number of ATM transactions and their fees. By planning your transactions effectively, you can optimize each transaction and reduce overall costs.

Keep in mind that ATM provider and location can affect fee structures. Therefore, thorough research and comparison are crucial before finalizing any transactions.

Bitcoin ATMs for Convenience

Bitcoin has been surging in value since 2013 when it was first launched. Around then, Bitcoin was trading as low as $13 and has since surged to reach as high as $73,000.

Bitcoin ATMs have also increased with this growth.

Line Graph Showing the number of Bitcoin ATMs rate over time in the United States

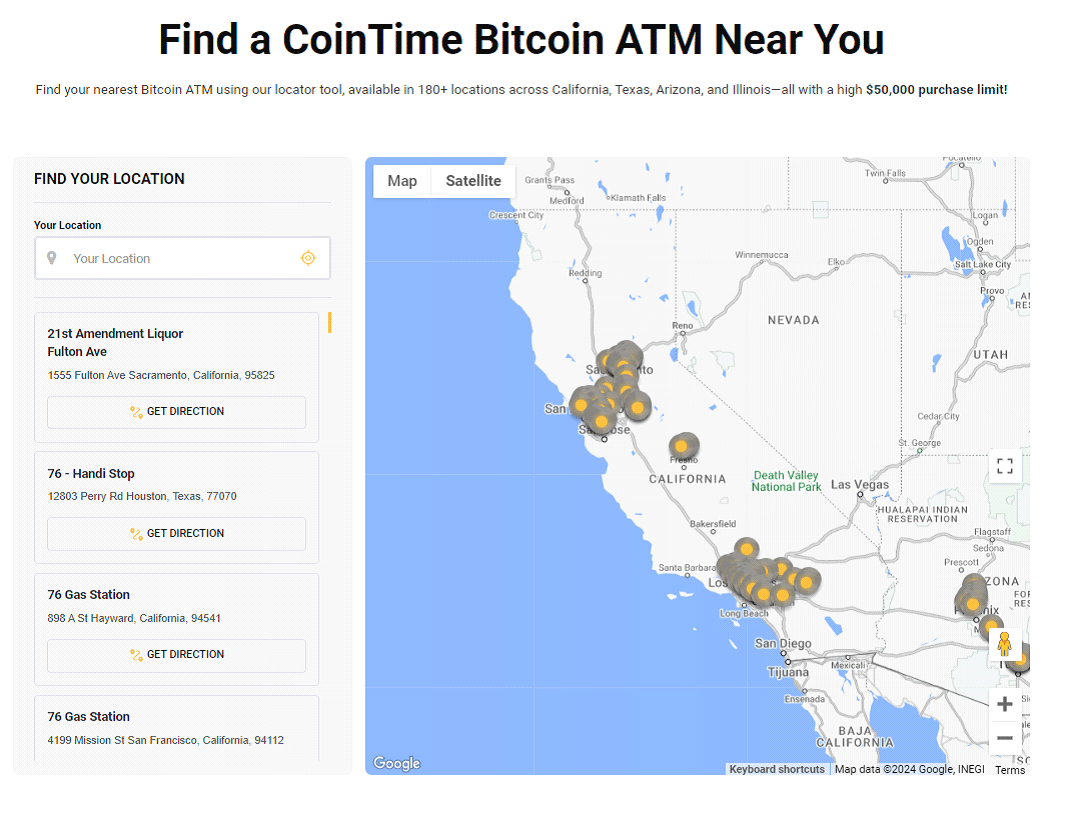

At CoinTime we provide a seamless experience for our users to buy and sell crypto using Bitcoin ATMs.

We offer over 150 locations to access secure and easy Bitcoin transactions.

It also has low fees and fast transactions, making them convenient for users.

Simply visit our BTM locator map page and check out the nearest Bitcoin ATM to your location.

FAQs

– Do Bitcoin ATMs charge a fee?

Yes, they typically do. Depending on the provider, Bitcoin ATMs charge fees ranging from 10% to 23%, to cover operational expenses.

– Why do Bitcoin ATM Fees Vary?

Bitcoin ATM fees vary due to operational costs, geographical location, and the specific operator.

– How much does a Bitcoin ATM charge per $100, $500, $1000, $5000 or $10000?

The amount of Bitcoin received for a $100 transaction hinges on the ATM’s fee rate.

For instance, with a 10% fee, you’ll obtain $90 worth of Bitcoin. Higher fees will proportionately decrease the amount of Bitcoin received.

– Can I send $10,000 through a Bitcoin ATM?

Yes, you typically can send $10,000 through a Bitcoin ATM. However, you need to confirm the limits for the Bitcoin ATM you intend to use.

Most Bitcoin ATMs have a daily limit of $10,000 for buying and selling Bitcoin in cash.

If you are looking to transact more, CoinTime ATMs offer a daily limit of $50,000.

– Can I withdraw cash from a Bitcoin ATM?

Yes, you can withdraw cash from bidirectional (two-way) Bitcoin ATMs, which allow you to purchase and sell Bitcoin.

– Why are the fees for using Bitcoin ATMs so high?

The Bitcoin ATM fees are associated with operational costs that come with running a Bitcoin ATM, such as leasing space and maintenance.

– Is it safe to use a Bitcoin ATM?

Yes, Bitcoin ATMs are generally safe.

They follow regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

This ensures a safe Bitcoin transaction.

– How do I find a Bitcoin ATM near me?

You can locate a nearby Bitcoin ATM using various online resources like CoinTime ATM which provides updated information on ATM locations.

– What do I need to use a Bitcoin ATM?

To utilize a Bitcoin ATM, you’ll require a Bitcoin wallet, a smartphone for wallet access, and cash or a debit card.

For larger transactions, a government-issued ID may be necessary for verification.

– How do I choose the right Bitcoin ATM?

When selecting a Bitcoin ATM, consider factors such as transaction fees, location, user feedback, and whether it’s a one-way or two-way machine. Choose reputable operators with transparent fee structures.

– What are Bitcoin ATMs?

A Bitcoin ATM is a physical kiosk that allows the purchase of Bitcoin and other cryptocurrencies using fiat money or a bank card.

These ATMs offer a convenient and simple way for users to participate in the crypto market.

There are two types of Bitcoin ATMs. The first is one-way which allows users to only buy Bitcoin.

The second is two-way, which allows for the buying and selling of Bitcoin for fiat.

Unlike traditional ATMs connected to the bank, Bitcoin ATMs are connected to the internet and interact directly with the blockchain.

When buying crypto, the transaction generated is recorded on the blockchain, and the acquired crypto is deposited into the user’s crypto wallet.

On the other hand, when selling, the crypto is deducted from the user’s wallet, and the Bitcoin ATM dispenses fiat money.

– How to Use a Bitcoin ATM?

The number of Bitcoin ATMs globally is large, and it keeps growing.

To use the nearest Bitcoin ATM, here are the steps you should follow:

- Find your nearest Bitcoin ATM: Use tools like CoinTime’s location page or a quick Google search for “bitcoin near me” to find a convenient Bitcoin ATM. Ensure a reputable and licensed operator operates the ATM by conducting due diligence beforehand.

- Select “buy bitcoin” on the ATM’s home screen: Once at the ATM, navigate to the option that allows you to purchase bitcoin.

- Review and accept terms and conditions: Take a moment to review the terms and conditions presented on the screen and accept them before proceeding.

- Verify your phone number: For security purposes, you may be required to verify your phone number before initiating the purchase process.

- Review the exchange rate: Take note of the current exchange rate displayed for your transaction to understand the value you’ll receive for your fiat currency.

- Deposit your bills: Insert the bills you wish to exchange for Bitcoin into the ATM. Some ATMs may have limitations on the denominations they accept, so be mindful of any restrictions.

- Verify the total deposit amount: Once you’ve deposited your bills, confirm the total deposit amount displayed on the screen.

- Complete the transaction: After verifying the deposit amount, select the option to “Buy Bitcoin” to finalize the transaction. The Bitcoin ATM will then process your purchase and print a receipt for your records.

By following these steps, you can easily and securely purchase Bitcoin using a Bitcoin ATM.

– How to Sell Bitcoin?

Selling your Bitcoin has similar steps to buying Bitcoin.

After locating the Bitcoin ATM nearest to you using CoinTime, here is what you need to do next:

- Select the ‘sell’ option: Choose the ‘sell’ option on the Bitcoin ATM’s screen, which is typically only offered at bi-directional Bitcoin ATMs.

- Verify your identity: Depending on the ATM operator’s requirements, you may need to verify your identity by entering a code sent to your phone number or scanning a valid ID.

- Scan the QR code: Scan the QR code linked to the wallet where you want the sold bitcoins to be transferred. This ensures that the bitcoins are sent to the correct destination.

- Choose the amount to sell: Select the number of bitcoins you want to sell. The ATM will display the equivalent amount in fiat currency based on the current exchange rate.

- Confirm the sale: Review the transaction details and confirm that you want to proceed with the sale.

- Execute the sale: Once confirmed, the ATM will execute the sale. The bitcoins will be removed from your wallet, and the ATM will dispense the agreed-upon amount of fiat currency.

Note!

We did our absolute best to collect the data above through all viable sources.

However, the actual fees might differ slightly from those in tables and graphs, and that’s up to the operators themselves.

So, feel free to correct us if you find something off or any inaccurate data. You can contact us through our form.