The digital currency realm is currently experiencing significant momentum in technology development and adoption, as evidenced by global innovations like Bitcoin ATMs.

These Bitcoin ATMs, designed to help trade cryptocurrency through on-the-spot orders, are convenient hubs for crypto purchases and sales orders and for sending money.

While many crypto enthusiasts are familiar with Bitcoin ATMs, they do not necessarily know how to optimize and use them for sending money.

This guide aims to walk you through the process step-by-step, covering how to send money through Bitcoin ATMs to transfer digital assets using debit cards or cash.

Table of Contents

ToggleKey Takeaways

- Cryptocurrency kiosks allow users to send money to anyone globally as long as they have a Bitcoin address.

- BTM machines allow Bitcoin transactions with both cash and debit cards, facilitating worldwide money transfers.

- With the debit card option, users can insert their card, confirm the recipient’s Bitcoin address, enter the transfer amount, and verify the transaction’s success.

- For cash transactions, users need to highlight the recipient’s address, deposit cash, and confirm the transaction.

- Bitcoin ATMs like CoinTime enhance global remittances through scalability, operational efficiency, and accessibility.

How to Send Money Through a Bitcoin ATM With Debit Card or Cash?

Sending money with Bitcoin ATMs is easy and quite similar to traditional ATMs.

However, they deal with cryptocurrency transactions.

It’s important to note that the steps for sending money across the globe might vary based on the BTM operator selected.

Regardless, here is a simple general framework that guides you in a step-by-step process of sending money with BTMs:

– Sending Money with a Debit Card:

Bitcoin ATMs can be employed for global financial transfers, and debit cards are acceptable for carrying out transactions.

Here is a detailed step-by-step guide:

1. Locate a Bitcoin ATM:

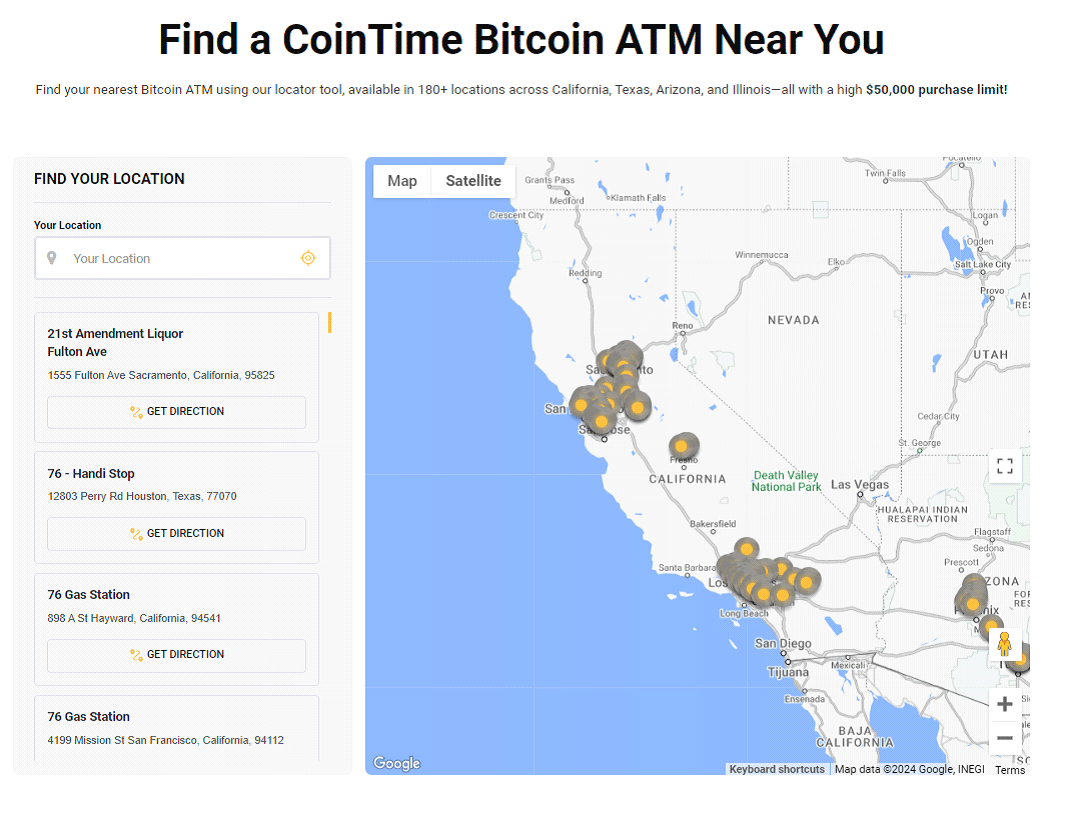

The very first step is to seek the Bitcoin ATM location using the Bitcoin ATM locator.

These locators are designed to direct you to the nearest Bitcoin ATM automatically.

Such can be translated easily with sites like CoinTime and CoinATMRadar, whose maps guide you to the nearby Bitcoin ATM.

Then, you will be prompted to provide your identity verification details and wallet details before you can get started.

2. Select Send Bitcoin:

After setting the BTM, press the crypto machine’s main screen button.

which leads you to send Bitcoin.

3. Input the Recipient’s Digital Wallet Address:

You will need the correct digital wallet address for the package type of crypto you are sending.

You can use the machine’s keyboard or scanner to find crypto wallet QR codes.

4. Select the Debit Card Option:

To start with, the Bitcoin ATM will require you to opt for a mode of payment.

Then, you will need to select the option “Card Debit”.

5. Fix the Debit Card into the BTM:

Insert the debit card into the cash machine’s card reader and press the displayed button for authentication.

Subsequently, add your PIN or any other type of personal identification method mandated by the BTM.

6. Enter Amount:

You’ll need to input the amount of Bitcoin you intend to send.

Be careful with this step and confirm the wallet address, the type of crypto being sent, and the correct amount budgeted to send in crypto or local currency.

7. Confirm the Transaction:

Read the information you entered and confirm if it is correct.

This would include the amount, wallet address, and mode of payment.

Then, confirm the transaction.

The BTM will scan the debit card account balance and withdraw the currency token to the selected recipient’s address.

8. Wait for Confirmation:

The transaction’s execution speed might vary based on network traffic, operator services, and the transaction fees selected (higher fees equals faster transactions).

Ultimately, after that, your transaction will receive approval, evidenced by a confirmatory ticket with all the transaction data.

– Sending Money with Cash:

Bitcoin ATMs can also be leveraged to send money using cash.

It’s a similar process to using debit cards but involves making cash deposits into the BTM.

Here’s how:

1. Find a Bitcoin ATM nearby:

Just like the debit card option, you’ll need to locate a BTM near your region using Bitcoin ATM locators.

According to the various BTM locators, crypto ATMs can be found in public settings such as malls or coffee shops.

2. Identity Verification:

After finding a Bitcoin ATM and feeding in your identity verification details and wallet info.

You’ll need to scan your wallet QR code.

3. Enter Amount:

Choose the amount you want to send.

This will include the fees selected and the type of crypto used.

4. Make a Deposit:

After confirming the amount, deposit the amount you intend to send.

You can feed the machine with as little as a $5 bill.

The deposit will include the sum of fees imposed and the amount being sent.

5. Enter Recipient’s Wallet Address:

You will have to fill in the cash amount you want to send.

The recipient’s wallet address should be fed as the next step.

You must discern the kind of cryptocurrency you intend to send from the available digital assets.

This would include tokens such as BTC, LTC, and ETH.

6. Confirm the Transaction:

The details, including the amount of the transaction and the recipient’s wallet address, will be displayed on the BTM screen.

Check if the information is correct and confirm the transaction.

7. Wait for Confirmation:

Just like using a debit card, the transaction speed will vary, but if all details are correct, a receipt confirming the transaction will be provided.

A ticket detailing the transaction will also be provided.

Bitcoin ATM Current Data Statistics

Based on market analysis, the Global Crypto ATM Market was first valued at $71.9 million in 2021.

The value has since increased, currently tagged at $1.18 billion in 2023 and set to reach $5.45 billion by 2030.

This represents a 62.5% CAGR. Various countries have contributed to the use of crypto ATMs, with regions such as El Salvador using Bitcoin as legal tender, making it likely to achieve that prediction.

As of January 2024, the number of BTMs totaled 34,000, but this represented a 10% decline in installations from January 2023.

The two main types of BTMs have been installed across 150+ countries, with various operators providing their services and CoinTime taking the lead.

CoinTime BTMs have various advantages, including 24-hour accessibility and a reliable support team.

There are 104 Bitcoin ATM companies around the globe that offer crypto transactions using their BTMs.

Top providers of quality services include CoinTime, General Bytes, Genius Coin, BitAccess, and Bitstop, among others.

In terms of prominence and coverage, General Bytes takes the lead with 11,527 machines installed in 60+ countries.

Genius Coin takes second place with 9,425 installed machines and BitAccess has machines in 7,888 locations.

Conclusion

Sending money using Bitcoin ATMs focuses on improving the ecosystem measures in money management for crypto enthusiasts.

Using debit cards or cash methods, you can send money to any place in the world at any time based on the BTM operator selected.

CoinTime BTM provides reliable services and a robust 24-hour support team.

By implementing the activities in this guide, you will use Bitcoin ATMs to your advantage and make secure and reliable transactions when sending money.

FAQs

– How do I send money through a Bitcoin ATM with a debit card?

To pay money with a debit card through a Bitcoin ATM, discover an ATM that supports Bitcoin or your preferred token, tap on “send money,” input the receiver’s Bitcoin address, output the debit card method, put your debit card into the ATM’s card reader, indicate the amount of money to send, confirm the transfer, and wait for the transaction to finish.

– Can I send money through a Bitcoin ATM using cash?

Cash payments would be the ideal means of getting Bitcoins via a Bitcoin ATM.

Approach a BTM, select the send money option, enter the recipient’s Bitcoin address, select the cash option, deposit a similar amount of cash in the machine, and confirm the transaction.

You can do this with your private key.

When notification of processing is done, wait for the transaction to be confirmed.

– Are there any limits on the amount of money you can send?

Yes. These restrictions are on a particular ATM operator in addition to having the ATM limits either being fixed at a few hundred up to several thousand dollars per transaction.

CoinTime offers a transaction limit of up to $50,000.

Other operators will vary between $10,000 to $40,000 limits.

– How long does transaction processing take for a Bitcoin ATM?

How long it takes to finish a Bitcoin ATM deal depends on various factors, including a busy network schedule.

As a rule, the transactions are confirmed comparatively quickly, and most are done within a few minutes.

Nevertheless, this area should also be highlighted, as delays could be connected to network congestion during the busiest hours.

– Is it safe to send money through a Bitcoin ATM?

Bitcoin ATMs are often considered secure devices if you follow specific security guidelines and choose service from reputable operators utilizing their verified machines.

Similar caution is appropriate for cryptocurrency transactions.

The transaction details should be verified thoroughly.